Venture Capital is a Giant Ponzi Scheme

The game nobody wants to admit they're playing

🎧 Listen on → 🍎 Apple Podcasts 🎵 Spotify ▶️ YouTube 📡 RSS Feed

Is venture capital the fuel behind world-changing innovation… or just a glorified pyramid scheme where everyone’s pretending they’re building the next Uber while actually praying for a higher valuation before the money runs out?

“If you can’t grow into your valuation, just find another sucker who thinks you will.”

— Every startup founder in denial

👋 In Episode 3 of UnicornPrn, Melissa and Lloyed expose how the game is played — founders chasing funding like junkies, markups for AI buzzwords duct-taped to a landing page, unicorn markdowns like it’s Black Friday, and accelerators slapping lipstick on broken products for Demo Day…

In this episode, you’ll learn:

✅ Why VC math makes founders lie to themselves (and investors)

✅ The billion-dollar valuation addiction—and who’s really winning

✅ The culture of fake wins and quiet shutdowns

✅ What happens when the market corrects and the music stops

✅ The NEW Startup OS

Let’s get into it →

🎭 Venture Theater: Where Outliers Are the Main Act

Let’s call a spade a spade.

Venture Capital sits at the top of the startup food chain—but sometimes, it behaves a lot like multilevel marketing. Early investors cash out by selling a dream to later ones. Founders raise at higher valuations to signal “progress” and justify the last round. And everyone’s just hoping someone with deeper pockets and fewer questions shows up before reality does.

There’s just one problem: most startups aren’t worth what they raise. And they never were.

VC has always been one of the riskiest bets in an institutional investor’s portfolio, especially compared to safer assets like public equities, real estate, hedge funds, or fixed income, where you get steady, diversified returns.

VC sits in the illiquid, high-volatility bucket: long hold times, high risk, and the hope of outsized returns, like catching Stripe, Airbnb, or OpenAI early.

The expectation? Most bets go to zero. The ones that don’t often take 10+ years to exit. A few will 10–100x and make the whole portfolio look like genius.

That’s why traditional portfolio theory doesn’t apply. VCs can’t say, “This company returns $100M, that one $50M, and it all averages out.” Every single investment has to have the potential to return the entire fund.

So VCs don’t invest in “safe” bets. They invest in statistical anomalies. Your startup has to be the jackpot, not just a good hand.

When VCs ask, “Can this be a $10B company?” it’s not because they love buzzwords or want you to fake TAM slides. It’s because unless your startup can generate that type of return, it’s not a good bet for them, even if it succeeds.

VC is a game of extreme outliers that makes the impossible possible. Without it, we don’t get the internet, the iPhone, CRISPR, self-driving cars, AI, or commercial rockets.

VC didn’t just fund moonshots, it reshaped how we move, stay, eat, socialize, scroll, and overshare. It funded the rails for much of modern life, and the world is better for it.

But here’s where things started to go south:

Somewhere along the way, every company started calling itself venture-scale…

And the Unicorn Dream went mainstream, breaking everything.

💡 So What the Hell Is “Venture-Scale,” Anyway?

Let’s clear this up.

A venture-scale company isn’t just “a good business.”

It’s a rocket ship with a believable path to $1B+ outcomes—fast enough to deliver 10x returns or more on invested capital, ideally within 7–10 years.

That means:

Giant TAM (Total Addressable Market)

Network effects, category dominance, or platform potential

A winner-takes-most dynamic

Massively scalable unit economics

The kind of startup that doesn’t just survive, but explodes into a generational company.

The problem? Most startups aren’t that.

They’re good businesses trapped in a venture-scale costume

Growing fast to please the cap table

Spending wildly to chase top-line

Burning years and millions trying to fake a trajectory they were never built for

What the “venture-scale journey” looks like:

It’s not a 9-5 — it’s a multi-year emotional rollercoaster

You need to accept the tradeoffs: control vs. capital, stress vs. scale

You’re committing to exponential growth and exponential uncertainty

You’re assembling a high-agency, resilient crew to ride the chaos with you

You’re ready for board meetings, fundraising cycles, pivots, and pain

You know the stakes: burn rates, dilution, layoffs, copycats, and exits

💸 The Unicorn Origin Story

Once upon a time (2013, to be exact), Aileen Lee at Cowboy Ventures coined the term unicorn… a rare, mythical startup that hit a $1B valuation.

At the time, it was meant to describe something almost impossible, a company that grew at an insane pace. But Silicon Valley heard “unicorn” and thought:

“Yeah, let’s make this the new bar for success.”

Fast forward to 2020, and nearly two unicorns were minted every day.

2003-2013: Finding a unicorn was like spotting Bigfoot

2015: 50 unicorns—startups go crazy trying to be one

2021: 1,200+ unicorns, mostly overvalued and burning cash

2023: More unicorns dying than being created. Oops.

Somewhere along the way, being a unicorn stopped being rare and started being expected.

Founders didn’t start companies to solve problems. They started them to become unicorns. And that’s when things got stupid.

📸 Valuation Markups = Insta Filters for Your Startup’s Financial Reality

While VC is a long game, VC funds are raised on short-term signals. Most VCs start raising their next fund before seeing a single dollar back from the last one.

And since exits take years, they rely heavily on markups (paper increases in portfolio valuation) to show traction to their investors (LPs).

Here’s how the incentive loop works:

Startup raises a new round at a higher valuation

VC marks up their previous investment on paper

That markup becomes the proof point to raise the next fund

That’s just venture logic… valuations and markups often outpace metrics and fundamentals like revenue, product-market fit, or profitability.

Sometimes, that upward trajectory plays out beautifully. But other times, the growth is more financial engineering than operational execution.

It’s why many startups get billion-dollar valuations before unit economics come into play. And why 70% of unicorns from 2021 haven’t raised at a higher valuation (up round) since.

As a founder, this matters. Because while your investors may benefit from early markups, your real value is only realized much later if the business fundamentals catch up to the hype.

In the meantime, just beware:

Markups can raise your profile, but they don’t pay the bills.

🚀🤠 Space Cowboys vs. Bankers in Patagonia Vests

Let’s talk investor vibes.

San Francisco VCs? They’re not funding safe bets, they’re swinging for anomalies. These are your space cowboys: high-conviction, upside-addicted, and ruthlessly allergic to “meh.” They don’t need a revenue model… They underwrite ambition over ARR. They need a story, a spike, and a whiff of category dominance. Got ‘AI’ on slide 2 and a Stanford dropout on slide 3? That $3M pre-seed check is already halfway wired.

Non-SF VCs? Whole different game. These folks lean banker. Notion diligence checklist. Five reference calls. They treat pre-seed like private equity treats rollups. They want a product, a GTM plan, early revenue, and a spreadsheet that shows 18 months to breakeven. They fund hygiene over hype. That $500K check? It comes with data room access and questions about churn before you’ve launched.

Where SF VCs underwrite possibility, non-Bay VCs underwrite probability.

This isn’t a dunk. It’s just different mindsets. One funds upside. The other manages downside. It all depends on the type of business you’re trying to build.

So what should founders do? Know your narrative. Are you swinging for 100x or optimizing for margin? Are you chasing exponential scale or stacking profits? Don’t pitch your Category Creation SaaS to a Midwest fund that thinks 80% gross margin is reckless. And don’t go to a top-tier SF fund with a “bootstrapped to $2M ARR” story coz they’ll send you to IndieHackers.

Pick your capital like you’d pick a co-founder… Once the wire clears, there’s no easy divorce.

🔥 The Accelerator Trap: Polishing Founders or Packaging FOMO?

Here’s the inside scoop most founders won’t admit: most accelerators say they help you build a business…

But in reality, their success is measured by how fast they can markup your valuation.

Their job? Get you from a $3M cap SAFE to $15M by Demo Day. Boom—instant paper returns on their 5%.

Your job? Pitch like a peacock, inflate your TAM, and get someone to bite.

You think you’re getting mentorship. What you’re really getting is trained to look fundable—to craft the right narrative, say the right buzzwords, and posture like a venture-scale founder, whether or not your business actually is... or whether you even understand what that journey truly takes.

📈 The Math That Broke Founders’ Brains

Blame it on the spreadsheet mafia.

The startup world adopted a simple formula: Triple-triple-double-double-double growth in the first 5–7 years, or GTFO… Specifically:

Year 1: Triple your revenue

Year 2: Triple it again

Years 3 & 4: Double it

Year 5: Double it again

That means:

Year 0: $1M ARR

Year 1: $3M

Year 2: $9M

Year 3: $18M

Year 4: $36M

Year 5: $72M+ ARR

The goal? Hit $100M+ ARR in 5–7 years.

That’s what it took to go from Seed to Unicorn. Anything else was considered too slow and not venture-scale.

Every investor deck became a work of fiction: hockey sticks, CAC payback periods, unit economics “coming soon.”

And because valuation became the scoreboard, founders started believing in their own fantasy projections.

Not because they were liars, but because that’s the only way to even get in the door with a VC.

Delusion became a prerequisite.

🧠 Delusion or Vision? When Founders Start Lying to Themselves

Every founder needs a little delusion—it’s how you jump out of the plane and build your parachute on the way down.

But somewhere between your third fundraise and fifth “growth experiment,” that delusion stops being motivational and becomes pathological.

You convince yourself you’re on a $100M ARR path and worth $1B, even though you haven’t nailed product-market fit.

You take on more capital to keep the charade going. And your VCs? They help you find another believer to keep the markup party alive.

At some point, you’re not building a business—you’re just perpetuating the illusion.

🥇 Who’s Really Winning? (Spoiler: It Wasn’t the Founder in That $3.7B Exit)

Here’s the founder fantasy: start a company, raise some money, build something awesome, and one day—walk away with life-changing wealth.

Here’s the reality: by the time the confetti falls and the TechCrunch headline hits, most founders barely own a slice of the pie they baked.

According to Carta’s 2025 data:

After a Seed round, founders still own ~56% on average.

By Series A? That drops to 36%.

Series B? Now we’re at 23%.

Series D? You’re clinging to 10%—if you’re lucky.

And remember, these are team numbers. So if you’ve got 3 co-founders, you’re probably each sitting on 3%–5% by the time the company’s “worth” $1B on paper.

Every Round Raises the Bar. And Shrinks the Exit Options.

The more you raise, the fewer doors remain open.

Raise at $10M valuation? You can sell for $50M and change your life.

Raise at $100M? Now you need a $1B exit just to make VC math work.

Raise at $300M? It’s IPO or bust. Most acquirers can’t afford you anymore.

And when the market shifts, your “next round” turns your cap table into a crime scene. You’re raising on worse terms, praying investors reply, and that unicorn status? Just means you're overvalued and out of options.

Now let’s get spicy.

Case Study: AppDynamics — $3.7B Exit, $160M CEO, Founder Shrinkage

When AppDynamics sold to Cisco for $3.7B, it was supposed to be a poster child for enterprise SaaS success. But look under the hood and the cap table tells a different story.

Founder Jyoti Bansal: Once owned the vision, the product, and the 10-year grind. By exit? Owned just ~12.2% after raising $300M+ across 7 rounds. Took home around $460M.

CEO David Wadhwani: Joined 18 months before the sale. Walked away with ~$160M.

Investors: Owned 65%+. Cashed in $2.4B+.

Now, Bansal still did well. But here’s the thing:

If you raise multiple rounds, your reward for success is a front-row seat to your own dilution.

And if you’re not careful? You’ll end up like the average founder:

Sub-5% ownership

Burned out by board meetings

Replaced as CEO

Hoping a $1B exit actually means something

Because here’s the kicker:

Carta’s data shows that by Series B, the average founder team owns just 23%. And among startups that raise over $100M, investors own 70% of the company.

Remember: the vast majority of VC-backed startups don’t exit at unicorn valuations or IPO. In fact, most go to zero, and many "exits" are just acqui-hires or fire sales dressed up with press releases.

In the venture game, raising capital ≠ getting rich.

Sometimes it just means you signed up for a decade-long pressure cooker, with nothing guaranteed at the end.

💸 Secondary Liquidity: The New Exit Strategy (When IPOs Ghost You)

Welcome to the new normal in venture capital.

In 2024, 71% of VC exit dollars came from secondary sales (Pitchbook), not IPOs (3%) or M&A (26%). That’s not a rounding error—it’s a sea change.

Historically, founders dreamed of ringing the Nasdaq bell or inking an M&A deal with Google. Now? Your best shot at liquidity is offloading your shares to another investor who needs a markup for their next LP update.

Let’s break it down:

A primary sale = new shares, new money in.

A secondary sale = old shares, new hands.

Sometimes it’s a founder cashing out 5% of their stake. Other times, it’s VCs offloading risk to crossover funds (public market investors dabbling in private deals), late-stage tourists (new VCs chasing hype without long-term conviction), or even other venture firms looking to make their fund look hotter than it is.

In a liquidity desert, secondaries have become the oasis.

Some examples:

Databricks let insiders and early investors cash out nearly $500M in a tender offer last year—despite no IPO in sight.

OpenAI is practically a secondary liquidity machine. Multiple tender offers have valued the company at $80B+, giving early employees monster returns—on paper, at least.

Figma had massive secondary interest pre-acquisition. Rumors swirled of employees cashing out at valuations well before Adobe’s $20B offer.

Rippling and Brex have used structured secondaries to reward early backers and retain talent, all while the public markets stayed shut.

With ARR targets for IPOs now at $250M+ (up from ~$80M in 2008), good luck going public anytime soon. And M&A deals are few and far between, especially if your last round was north of a $100M valuation. Secondaries are your only shot at liquidity.

“This is not just a temporary anomaly, but a structural evolution in how venture capital will function and ultimately evolve to look a bit more like private equity, with secondaries acting as the release valve when IPOs and M&A stall.” - Tomasz Tunguz, Theory Ventures

TL;DR: If you’re waiting for the IPO or M&A fairy, she’s out on sabbatical. These days, the real liquidity comes from secondaries… quietly, privately, and often long before the business fundamentals catch up.

⛰️ The Myth of “Think Bigger”

Here’s a story that starts like most unicorn pitches… with bold claims, big checks, and a founder chasing legacy.

A friend of ours shut down his company after 10 years, $50M in venture capital, and $1M in friends-and-family money.

Gone. Dead. No returns, just regrets instead.

Back in 2018, he tried to recruit Lloyed. The pitch?

“We’re going to be a unicorn. Get in now, or get left behind.”

Lloyed passed. That’s when the founder leaned in and said the quiet part out loud:

“Your company is a lifestyle business. You’re thinking too small.”

Come again?

Apparently, unless you’re raising monster rounds, hiring an army, and swinging for a $1B+ exit, you’re wasting your life.

Fast-forward a few years:

Lloyed and his co-founder bootstrapped Boast.AI to $10M+ ARR.

They had a life-changing liquidity event by selling a partial stake to a growth equity fund and stepped into board roles.

They didn’t raise $50M.

They didn’t burn $49M trying to find product-market fit.

They didn’t end up with zero.

They built a real business, the kind you can run, scale, and step back from.

And they did it around the same time our founder friend shut his doors for good.

Ambition isn’t about vanity metrics… It’s about building a business that won’t ghost you in a downturn.

🪨 What No One Tells You About Being Stuck at the Top

That founder wasn’t alone.

Another friend raised $75 million, scaled to $35M ARR, and for a while, everything looked golden. He had the Forbes profile, the hype round, and the “we’re just getting started” energy.

Then 2023 happened.

Growth stalled. Layoffs hit. Expansion plans died quietly in the Q1 board meeting.

Now? He’s spending his days rewriting pricing decks and trying to squeeze upsells out of the same 25 enterprise customers… while praying a strategic acquirer takes the bait.

We grabbed lunch last month. He didn’t touch his food. Just stared down at the table and said:

“We’re worth $1B on paper... and I feel like I’m running a ghost town.”

This is the part nobody preps you for.

You get the funding. You build the machine. And then you stall.

Eventually, you realize you’re operating a billion-dollar startup with no momentum, no margin, and no way out.

A unicorn in valuation. A zombie in reality.

🧟♂️ Zombie Acquisitions: When Founders Trade Cash for a Cover Story

Here’s a Ponzi-adjacent move dressed up as a strategic acquisition: Founders selling their flatlined startup to an overvalued one, in an all-stock deal.

One founder friend had a solid team, a loyal customer base, and $10M of investor money remaining in the bank—but traction had stalled, and the founders were burned out.

Then a “hot” startup—fresh off a monster round at a billion-dollar valuation during the pandemic—offered to acquire them. All stock. No diligence. Just vibes.

On paper, it looked like a win. The acquiring company was buzzy, still getting headlines. Investors could mark up their equity instead of writing it off. Founders could say, “we got acquired.” And nobody had to write a postmortem.

But under the hood? The acquirer was bleeding cash and barreling toward its own cliff.

So what really happened? The startup traded $10M of real investor money for stock in a zombie unicorn with the same inevitable fate, just slightly delayed.

The founders got narrative. The investors got fiction. Nobody got their money back.

If you take other people’s money, your job is to protect it, not bury it in someone else’s cap table.

Don't confuse a soft landing with a responsible one. Sometimes “we were acquired” just means “we bailed early and hoped no one noticed.”

Because at the end of the day, you didn’t save the ship… You just rearranged the deck chairs on the Titanic.

💀 The Aftermath: What Happens to the Failed Unicorns?

Here’s what the media won’t tell you:

Many unicorns are unicorns on paper, but zombies in practice

Most “acquisitions” are acqui-hires or asset fire sales

Most “quiet shutdowns” had founders cashing out early

And yet, those same founders are now raising new rounds, launching new companies, or becoming angel investors.

It’s a cycle. And it repeats… until someone breaks it.

⚖️ The Rise of Autonomous Businesses: Henry Shi’s $100M ARR Wake-Up Call

Let’s talk about Henry Shi, co-founder of Super.com (formerly SnapTravel). He built a $100M+ ARR unicorn, raised over $150M in VC funding, and scaled a massive team.

Textbook success story, right?

Not quite.

Here’s what Henry says now:

“If I were to start another company today, I would not do the same thing again.”

Why? Because chasing the unicorn playbook cost him something even more valuable than cap table ownership: control.

To get to $100M+ ARR, he:

Hired hundreds of people

Pitched to hundreds of VCs

Went through the exhausting Series A, B, C treadmill

Lost the ability to steer the company without multiple layers of investor oversight

Despite all the traction and metrics, raising $150M required 250+ VC pitches, 99% rejections, and months of energy drained… all just to keep the lights on and the machine growing.

And guess what? None of it made the journey more fulfilling. It just made it opaque, frustrating, and distracting.

If Henry were starting today, here’s how he’d do it:

AI-native from day one

Bootstrapped or Seed-strapped (raise one small round to profitability) to keep optionality and control

Focus on speed, autonomy, and customer obsession over board meetings and burn rates

No massive headcount

No traditional VC treadmill

“The next decade won’t be owned by unicorns. It’ll be ruled by autonomous businesses—AI-native orgs with lean ops, superhuman productivity, and minimal headcount.”

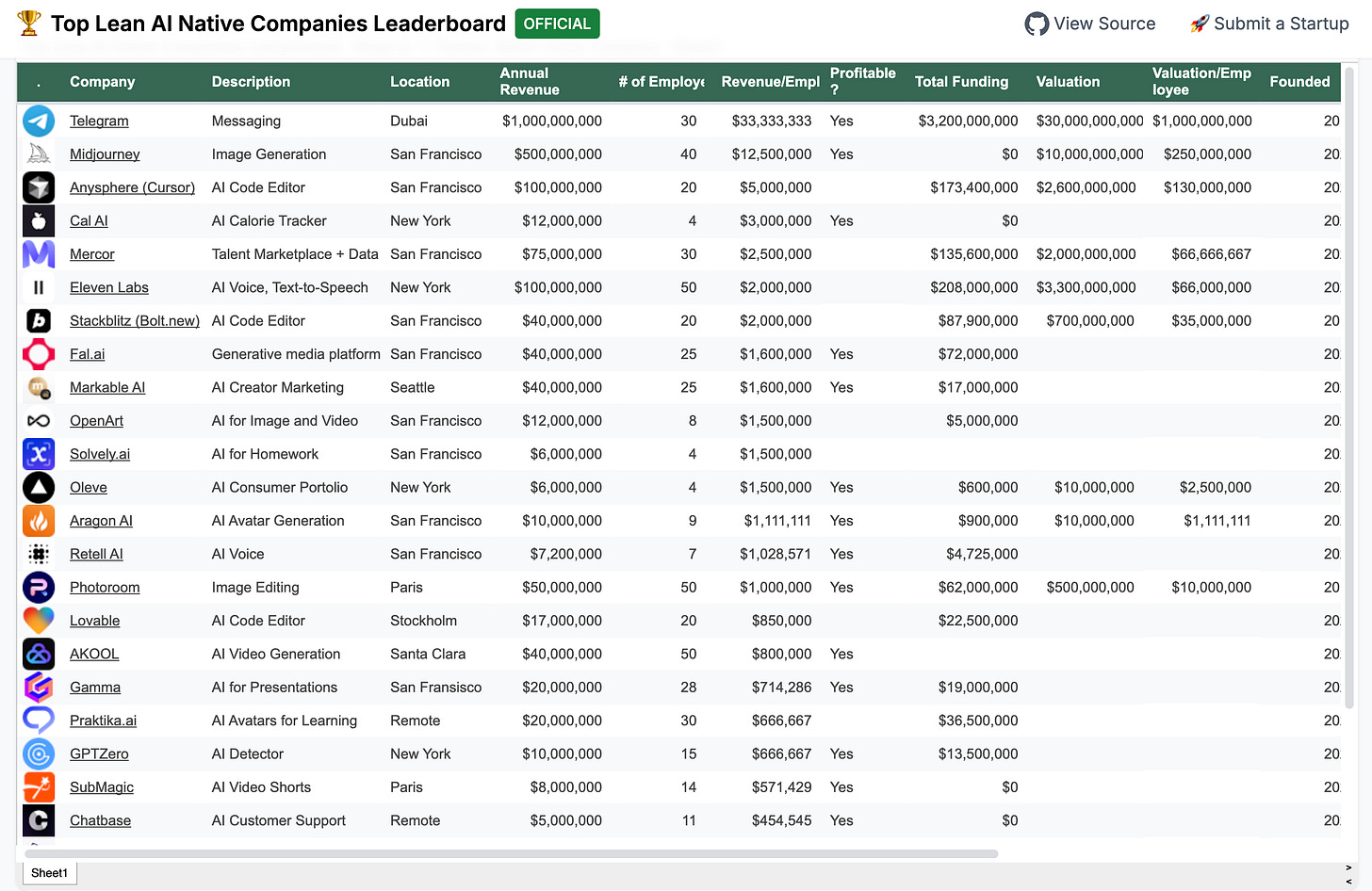

See Henry’s leaderboard of AI-native startups printing millions with <50 people.

🦄 From Unicorn to Centaur: Bessemer’s $100M ARR Reality Check

For the last decade, "Unicorn" was the crown jewel of startup vanity. A billion-dollar valuation? That meant you made it, baby. TechCrunch headline secured. Fancy hoodie approved. Down round pending.

But somewhere between the third pivot and the fifth round of layoffs, reality slapped the ecosystem in the face—and out came a new hero: the Centaur.

Coined by Bessemer Venture Partners in 2022, a Centaur is a private SaaS company with $100 million or more in ARR. No more pretense. No more “on paper” unicorns with $12M in revenue and $900M in burn. Just cold, hard, bankable revenue. Real traction. Product-market fit that doesn’t need six layers of narrative architecture to explain.

Why does this matter? Because when the market corrects (as it did in 2022), investors remembered a very simple truth: Valuation is a story. ARR is a scoreboard.

In Bessemer’s words:

“At $100 million ARR, a startup is an undeniable success. It is impossible to build a $100 million ARR business without strong product-market fit, a scalable sales and marketing organization, and a critical mass of customer traction.”

Translation: You can’t fake your way to Centaur status. You either have the customers… or you don’t.

Remember when it was cool to raise $150M just to get to $15M ARR?

Yeah, that era is over.

Centaur status isn’t just a new milestone—it’s the ultimate filter for signal vs. noise. Because in this brave new world of down rounds, cash discipline, and AI-native competitors doing 10x your output with 1/10th the headcount, $100M ARR is the line in the sand.

Unicorns are paper tigers. Centaurs are actual operators.

Unicorns win headlines. Centaurs win markets.

And here’s the kicker: out of 1,500+ Unicorns, there are only ~160 Centaurs—making them rarer and way more badass than a fictional billion-dollar valuation.

🎯 ARR per Employee: The Metric Nobody Told You About

You want to know which startups were always doomed?

Just look at ARR per Employee. It’s the canary in the unicorn coal mine.

Take Hopin and Bench Accounting:

Hopin hit ~$100M ARR with 1,100 employees. That’s about $90K per head. Bench reached ~$15M ARR with 650 people—roughly $23K per head. Both are now dead.

Not because they didn’t execute, but because they were playing the wrong game.

Now compare that to the AI-native breed:

Mercor does $48M ARR with just 30 people. That’s $1.6M per employee. Aragon? $10M ARR with a 9-person team—over $1.1M per head.

That’s not a margin difference. That’s a new operating system.

If you’re not tracking ARR/FTE, you’re not tracking reality.

⚔️ Old OS vs New OS: The Battle of Operating Systems

There are two startup playbooks in the wild:

Old OS (Unicorn Bloatware):

Raise big, hire fast

Add layers of management

Burn runway for years

Pray the unit economics work out later

New OS (Autonomous Businesses):

Lean teams, AI-native processes

Strategic autonomy at every level

Operate at 10x output with 1/10th headcount

Focus on customers, not just capital

One’s bloated. The other’s built for survival.

It’s time to stop treating fundraising as success. That’s not the game.

The game is:

Can you build a profitable company that people love and pay for?

Your scoreboard isn’t your valuation.

It’s your retention, margins, growth efficiency, and ARR per head.

You don’t hire to scale.

You automate to scale.

You don’t raise to survive.

You raise to accelerate what's already working.

🧘♂️ Before You Chase Venture-Scale, Ask Yourself This

Most founder advice is about sprucing up your pitch, inflating your TAM, and making your startup look like a billion-dollar gold mine.

But the real questions aren’t about the money you want to raise. They’re about the life you actually want to live after you raise it.

Because once the money hits your bank account, the pressure hits your soul.

So before you step onto the VC treadmill, ask yourself:

💭 What does success mean to me—personally?

Not money. Not vanity metrics. But the life you’d actually live if you had the money already.💸 How much money would it take to fund that life… forever?

Be honest. You probably don’t need $100M to be happy. You just need to stop pretending you do.🚩 Is there a version of my company I don’t want to work for?

If you’re not careful, that’s exactly the version you’ll end up stuck in. Use this to define your non-negotiables.🕰 How long do I want to run this thing?

Because if the honest answer is 5 years, don’t build a company that traps you for 15.

We don’t ask these questions enough, because somewhere along the way, “thinking clearly” got rebranded as “thinking small.”

But here’s the deal:

When you’re burnt out, stuck in a board-controlled company you barely recognize, society won’t bail you out…

You’ll be the one holding the bag—tired, alone, and still trying to convince yourself it was “worth it.”

Great companies are built on great alignment. Start with yours.

🚫 How to Not Be a Ponzi Founder (A Tactical Framework)

Let’s get real: if your plan is to raise → inflate valuation → raise again → pray for exit…You’re not a founder. You’re a con artist with a Cap Table.

Here’s a better playbook:

🏗 Start with customer pain, not investor hype.

Solve something real. Profitably. Before you fundraise.

⚙️ Leverage AI like it’s your cofounder.

Automate ops. Boost output. Build with leverage from Day 1.

👥 More people ≠ more progress.

Bigger teams slow you down. Stay lean. Move fast.

📊 Obsess over real metrics.

Measure user engagement religiously. Nail Net Dollar Retention. Know your CAC payback period cold. Fixate on ARR per employee. Guard your gross margin like gold.

🛠 Don’t scale a leaky funnel.

Pouring money into growth without retention is just a shortcut to bankruptcy.

🚫 Don’t let VCs define your ceiling.

Most unicorns are just survivorship bias in a pitch deck. Build something that thrives—with or without them.

🧠 Tiny + Profitable > Big + Burnt Out.

A calm $10M ARR machine is sexier than a $1B zombie unicorn on life support.

💸 Profit buys you time. Bloat buys you regret.

Stay in the game long enough, and luck will find you. Just don’t burn out trying to impress people who won’t be there when it matters.

📈 Only raise when your engine works.

Use capital to accelerate what’s already working, not to search for answers.

🪵 Build a business that could live forever—even if you sell it tomorrow.

Because freedom, durability, and staying power will always be hotter than your last TechCrunch headline.

🪙 When to Raise, How to Raise, and Who Not to Raise From

Fundraising isn’t evil—it’s just frequently misused.

Raise if:

You have a venture-scale business and are prepared for the journey

You’ve got customer pull and real traction

You need capital to capture demand, not find it

You know exactly how $1 will become $3

Don’t raise if:

You’re faking a venture-scale trajectory just coz you need startup capital

You’re “figuring it out”

You want validation

Your business has a thin margin and no retention

And never raise from people who don’t understand your business model or market. Your cap table should be strategic, not just rich.

🧃 Reminder: Tiny Raise, Trillion-Dollar Outcomes

Here’s a plot twist the VC hype machine won’t tell you:

The most iconic, enduring companies didn’t raise billions to win. They raised small, stayed lean, and built real businesses.

Apple raised just $3.6M in 1977. Now worth $2.6T.

Microsoft raised $1M in 1981. Today? $3.1T empire.

Amazon took $8M from Kleiner Perkins. Now sitting on $1.9T.

Google raised a modest $25M pre-IPO. Worth $1.9T+ (Alphabet).

They didn’t scale with burn, they scaled with revenue.

The myth? You need to raise big to go big.

The truth? Raising small forces clarity, speed, and focus.

In most cases, the best cap table is the smallest one.

More capital ≠ better outcomes.

More capital = higher expectations, faster burn, and more dilution.

The myth of “raise more to win” gets pushed by folks whose job depends on you raising more.

✨ Final Take: The Age of Autonomy Has Begun

Unicorns had their moment. The future belongs to Centaurs—lean, autonomous, AI-native businesses charging toward $100M ARR without the bloat.

If you’re still trying to brute-force scale with headcount and FOMO fundraising, you’re already obsolete.

The next generation is building quietly, profitably, and autonomously.

You can keep chasing UnicornPrn…

Or you can start building a real business. Your call.

🎧 Listen on → 🍎 Apple Podcasts 🎵 Spotify ▶️ YouTube 📡 RSS Feed

📩 Forward this to a founder before they chase UnicornPrn and regret it.

Got something spicy you want us to cover? DM us on LinkedIn — it’ll stay anonymous.

🌈 Unfollow the Rainbow!

— Melissa & Lloyed